Financing Your Clark County Home Purchase with No Cash Down, and US Government Backing

One of the perennial drawing cards for people wanting to move to Clark County has been the opportunity to either own a home on acreage in the country or, live in one of the several fine small towns near Vancouver, and perhaps slow down just a little bit. It is also a lesser known fact that there still are livliehoods taking place with work and jobs available in the rural parts of the County. To make purchasing a home in a rural town or, a rural property more feasible, the US government via the Department of Agriculture (USDA) offers the Rural Development Single Family Guaranteed Loan Program.

Here's Vancouver Realtor John Slocum with more information:

Background: Rural America has a long history of quality programs from the US Government to promote and improve the quality of life and affordability to live in a rural area. The Rural Housing Administration (RHA) and Rural Electrification Administration (now the Rural Utilities Service - RUS) were spawned from the New Deal programs from the Great Depression and Dust Bowl days, and provided financial assistance to rural areas for housing and to deploy electrical distribution and telephone infrastructure to rural communities. To be sure, a big driving force behind these programs is to better ensure the health of US Agricultural areas and the primary food supplies for our nation. The government department handling these programs is appropriately enough, the US Department of Agriculture (USDA). The USDA Rural Development Home Loan has been around about the same length of time, and has evolved over time to its current modern form.

How Does the USDA Home Loan Work in Clark County?

Here are some of the Key Financial Elements of the USDA Home Loan:

- Low to Middle-Income Households are generally eligible - If the Household Income is too high, you may be ineligible.

- 30 Year Fixed Term Loans at Today's Low Interest Rates -- these are fully amortized loans with no gimmicks.

- Qualifying rations are 29% for Housing and 41% for total debt.

- Guarantee Fee applies, and may be rolled into the loan.

- Zero Cash required for the Down Payment. Even some or all of the Buyer's Closing Costs may be financed if eligible.

- Flexible Credit Guidelines, where non-traditional histories may be accepted.

- Eligible properties include: Existing Homes, New Construction, New Manufactured Homes, Modular Homes, and eligible Condos!

- Eligible Repairs may be included in the loan as well!

- Applicants apply with an approved lender of their choice (we know several good approved lenders).

- Home must be in an eligible area.

What Parts of Clark County Are Eligible for the USDA Home Loan?

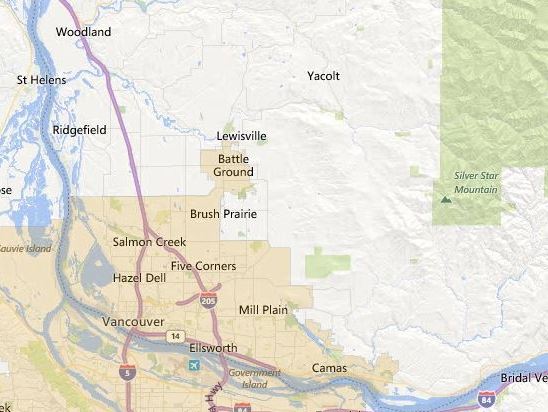

With Clark County being a part of the Greater Portland / Vancouver metro area, the USDA has provided a map of the Ineligible southern part of the County which means, the remaining northern part of the County is eligible. Here is the map courtesy of the USDA:

From this map we know these areas should qualify:

All of Amboy, La Center and Yacolt;

The Clark County Portion of the Woodland zip code;

Ridgefield north of 179th Street;

most of Brush Prairie and Hockinson.

For these the property must be outside the city limits: Battle Ground, Camas and Washougal.

UPDATE 2018: Areas now excluded are within the city limits of Battle Ground, Camas and Washougal.

Are There Any Other Important Items to This Loan Program?

Here are a few more items to check off before looking into this loan or at a particular property:

- Must be Owner Occupied as the Primary Residence;

- Home must not be used to produce Income, nor can there be Income Producing Buildings or other Accessories that produce Income on the property;

- 30 year fixed rate of interest with no down-payment required (repeat from above);

- Home must be structurally sound and in reasonably good repair.

- Probably won't be a Mansion or Castle.

Thus, this loan cannot be used for a Rental Property or, be a major fixer. Otherwise, a relatively high percentage of the rural Clark County homes should qualify.

When I was growing up Clark County was still considered a mostly rural area but now, there has been considerable growth to the extent it can sometimes be hard to believe there is still quite a bit of "rural Clark County" left! We have worked with several clients that truly like the benefits of this program.

If you have an interest in this type of loan and home purchase please give me a call (John Slocum) at 360-241-7232 .